5 of My Favorite Personal Finance Smartphone & Tablet Apps | Molly’s Money

If this is your first time here, Molly’s Money is a regular series I write on this blog that includes ALL things personal finance – debt management, budgeting, home buying, savings,investment, etc. I am NOT a financial advisor, but I am married to one! These are just things that I have learned over the years as I struggled with my own personal finances and ultimately, became debt free in 2012. Got a question about money that you want answered? Leave it in the comments below or email me!

While I like to “kick it old school” in a lot of ways with regards to managing my personal finances (ex: keeping track of our budget in Google sheets / Excel, cash envelope system, etc.), I do LOVE a lot of apps that help keep track of money and financial things.

I get asked A LOT by my readers which personal finance apps I recommend the most and I realized I’ve never shared a post on my favorites. So, I thought there’s no time like the present!

Here are some of my favorite personal finance smartphone / tablet apps for managing and keeping track of all your money (these are in no particular order):

1. MINT

Mint is awesome for so many things. You can connect it to most bank accounts and it will track all your spending habits. You can set different budget constraints and it will warn you if you’re approaching your budget limit or if you’ve gone over in a particular category. You can also set reminders for when certain bills need to be paid, etc.

They have a website AND an app, so if you don’t have a smartphone, you can access it from your computer!

2. Credit Sesame

I’ve done an entire post on how much I love Credit Sesame. They’ve made so many great improvements to it over the years! It’s my favorite way to keep track of my credit score and manage credit alerts. It’s NOT a substitution for pulling your annual credit report, but it is a GREAT way to just keep an eye on what your credit score looks like and see if there’s anything that looks out of order.

3. Your Bank’s App!

Okay, I realize this is pretty general… BUT… with that being said, MOST major banking institutions have an app… and the larger ones (Bank of America, BB&T, Wells Fargo, etc.) have awesome features like the ability to mobile deposit checks, transfer money between accounts, and some you can even do mobile bill pay!

This is obviously going to be a little more specific to your bank, but I wanted to share in case you didn’t know. We use BB&T and I love being able to so easily access and monitor all of my accounts, pay bills, and transfer money right from my phone.

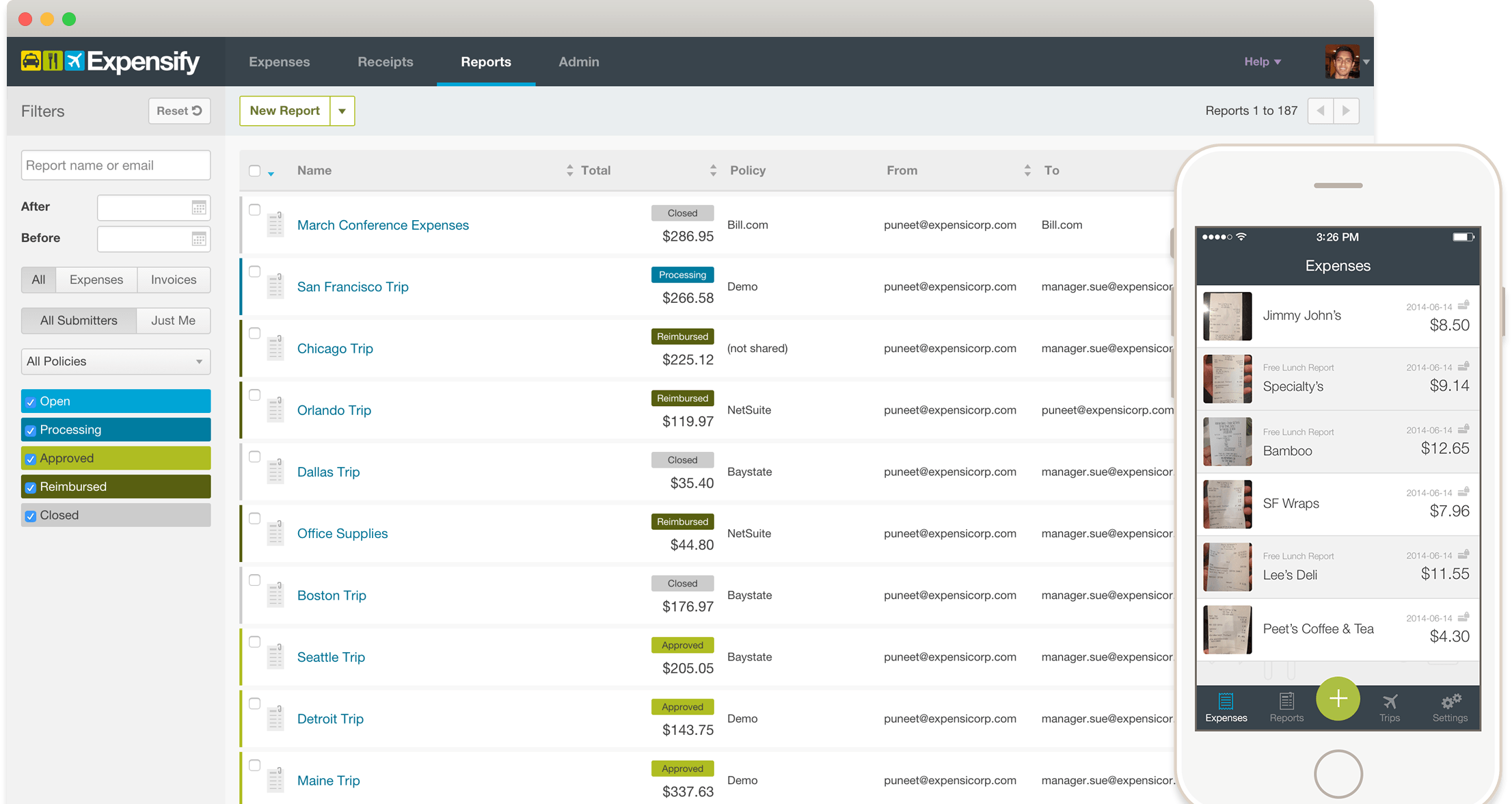

4. Expensify

This may sound counterintuitive because, technically, it’s not a “personal” finance app, but a “business” finance app… but since tracking these things correctly ultimately effects your personal finances, I thought it was important to include it.

If you are a small business owner OR if you work for a company and have to report expenses to get reimbursed, Expensify is the app for you! It allows you to take photos of receipts and it will track your expenses and put them into one report. Everything from gas, to business meals, etc. This is seriously a MUST HAVE app if you do any type of tracking of expenses for work / business.

5. BUDGT

Image via Budgt

Budgt is another app that is fantastic for tracking expenses, keeping track of your budget, and just looking at an overall profile of your money. It’s pretty low frills and very user friendly. It’s very similar to Mint, but has a different interface and is a little simpler, I think, to use.

Thanks for the great list of personal finance apps! Your recommendations make it easy for anyone to navigate the world of budgeting and saving. I especially love how you highlighted the user-friendly features of Mint and the proactive budgeting approach of YNAB. Keep up the fantastic work!

My husband and I started using You Need A Budget (YNAB) last fall and it has made a tremendous difference for us. Sounds similar to Budgt, from what you’ve written here, except that they not only provide the web-based program and app, they also have webinars to teach you how to budget while using the app. I don’t think I’ve been following you long enough to have seen other money-related posts, so I don’t know if you have used Financial Peace University, but YNAB seems to me a good digital alternative to an envelope system. My husband and I never could really get into FPU all the way because we just knew we would not carry cash. That doesn’t work for us. But we did like the idea of the envelope system (which, I suppose if you get right down to it is just a physical representation of a budget?).

Anyway, we used to keep up with everything via spreadsheets, but having an app makes it much easier for us to keep up with everything in real time. If I’m at work and I need to make an emergency stop on my way home for a grocery item for dinner, I can easily check and see how much grocery money I have left, and after I make my purchase, enter it immediately into the app. We’ve struggled with budgeting for so long, it feels great to finally have a working grasp on it. Our spending is more intentional and we anticipate expenses and save up for them much better than before. It’s weird because it’s actually freed up our money by restricting it.

Whatever app or program people decide to use, I encourage everyone I know to find some way to create a budget system that works for them. It makes a difference not only in what we’re able to do with our money, but our whole attitude toward money. We have a clear vision of what we want our money to do, and we control it, rather than being impulsive and letting it control us. My husband has had such a weight lifted from him. He used to stress so much about money. It’s a relief to me that it’s a relief to him. 🙂